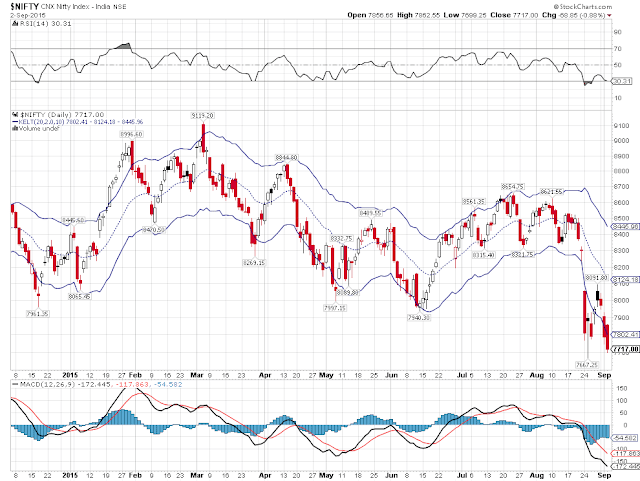

Bottom Line: We are in last leg of the first

correction of our multi month Bull Run. We will not enter Bear trajectory until

Nifty breaches and close below 6580 for three consecutive days.

Good Morning!

Am going to keep this short. Nifty’s price action suggests

little more downside is on its way. However I was wrong in anticipating it to

be a free fall towards 7400. Rather than a free fall we witness a zig zag fall

in place for nifty. This shows how strong our ongoing multi month bull run is. 7400

is going to stay, and it would be interesting to watch out for how Bulls behave

once hitting this level.

The trends for the day.

Long term Trend: Correction to the ongoing Bull Run.

As long as we hold on to 6580 we will not turn negative on the long term view

of Bull that we hold.

Intermediate term Trend: Trending Down. Looking at the

trending pattern on the intermediate time scale, am not fully convinced the way

it unfolds. Any positive move above yesterday’s high at 8044 will change the

pattern back to neutral.

Short term Trend: Trending Down. The trend will not change

until we close above 8200, which means 8200 would act as SL for those who are

short in Nifty.

Stay tuned for tonight,

as I answer some stock related questions that we have received for the section “ask

Pathiyil”

Safe Investing!

Comments

Post a Comment