Bottom Line: We are in last leg of the first

correction of our multi month Bull Run. We will not enter Bear trajectory until

Nifty breaches and close below 6580 for three consecutive days.

Good Morning!

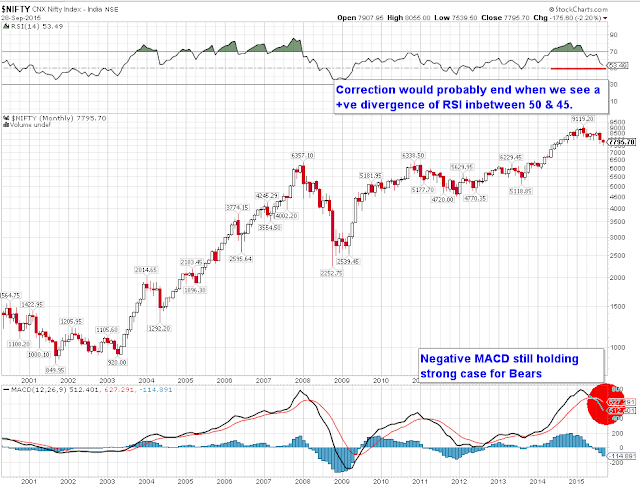

Let us look at the Nifty chart first on a larger time frame

before we proceed on in understanding what is going to happen in the next 2-3

days. Let us look at the main picture first.

Looking at the main picture, it is very clear that we are

still in the final leg of this correction. This could take more time before we

break out of this correction. The reason why it is taking more time in getting us

out of the correction zone is very simple; this correction is actually an

accumulation phase.

Looking very closely at the stocks of the broader market, one

can understand one thing that people are accumulating good stocks on a daily

basis taking leverage of the ongoing correction that we are witnessing. Though

the broader markets may be moving down with each passing day, we find good

stocks which could move up once the markets turn up are finding more

accumulation rather than distribution, which we usually see in any correction

phase. In short we find smart money moving from the not so fundamentally strong

stocks to that of fundamentally strong stocks.

Looking at a minor time frame of Nifty chart, one thing is for

sure that this zig zag move would continue further and this will take even more

time than what we were even thinking of. Technically speaking on the technical

parameters of this daily chart one could observer, as we have indicated earlier

this month, the RSI really did turn down after hitting the 50 mark and on the MACD

indicator it is giving a kind of convergence and it could turn down very soon

starting a new sell off.

The immediate targets that I am looking out for on the Nifty,

on the downside is 7540 and 7460. These are the two levels that we are keenly

watching out on the downside. At the same time we are looking out for 8100 on

the upside. This zig zag zone could probably drag Nifty further down in the

next two sessions. Especially having Governor’s action round the corner, I

strongly feel that nifty has more potential to move downwards.

Considering all these, I suggest rather than betting on the

zig zag moves, to start accumulating stocks which are really really strong and

wait patiently for the correction to wind up. Once we start moving on the

upside, we could gain wealth many times over investment. Once the correction

ends, the target that I am looking for on nifty (on the upside) is around 14,000.

This means that real good stocks could fetch you 5-6 times of what you have

invested over the next couple of years. So be patient, start accumulating very

good stocks rather than falling prey to this zig zag move of Nifty. Stay

invested, be patient and enjoy the fruits of the markets.

The trends for the day.

Long term Trend: Correction to the ongoing Bull Run.

As long as we hold on to 6580 we will not turn negative on the long term view

of Bull that we hold.

Intermediate term Trend: Trending on the downside with

immediate supports at 7540 and 7460.

Short term Trend: Trending Down. The trend will not change

until we close above 8100, which means 8100 would act as SL for those who are

short in Nifty.

Thank you!

Great

ReplyDelete