Good Morning!

It has been years since I have updated my views on Nifty

through this blog. In the past four years things have changed dramatically,

especially for the stock market. Nifty which had been struck in a range, have

broken out and had witnessed a steady rally since then. For this reason, even

before I start blogging Nifty daily updates, let me update you on the longer

term view and intermediate view on it. Along with Nifty updates, starting next

month, I will also start sharing my views on stocks, currencies and

commodities.

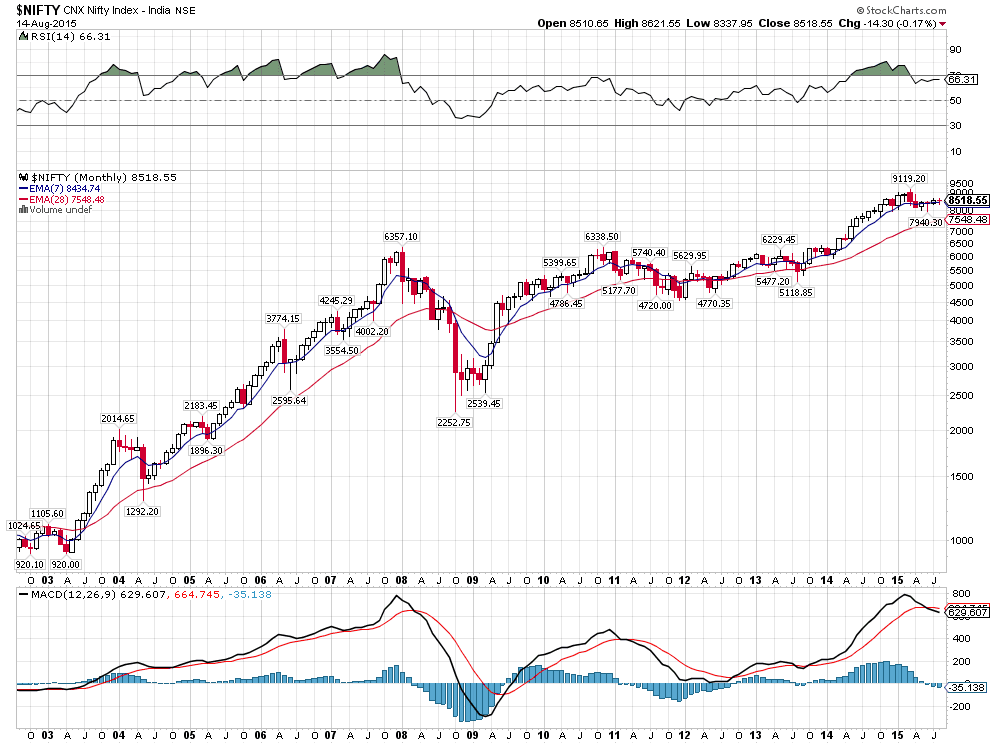

Nifty – Long term outlook

Let’s look at the Nifty’s monthly chart to understand the

long term outlook. Many technical analyst consider December 2013 as a break out

month, but for me it’s month of September when things (especially technical

indicators that I look out for) have started moving on the positive note. Ever

since September 2013 when this current rally began, Nifty had been making

impressive moves favouring the bulls. The multi month Bull Run have gained

momentum with each passing year. Technically speaking, the multi month Bull Run

is far from over, rather I would say we have just began and have many more legs

to witness in this rally. Looking at the chart closely and especially looking

at the technical indicators, RSI and MACD it’s evident how things have started

to cool off in the past six months, i.e. we have entered into a correction

phase. This marks the first correction phase post the technical breakout that

we have seen in September 2013. The question remains unanswered, is the

correction over? Well this question would have be backed by the up move that we

have witnessed in Nifty from 7940 levels. To answer this question, we need to

go and look at the Nifty chart with lesser time frames like Weekly and Daily

chart. However, am going to make this blog more curious and wanted to share

knowledge rather than giving you answers (that one number called target) all

the time. So, this would be the topic for blogging tomorrow.

One definite thing to carry today: Nifty’s multi month Bull

Run has begun and has more legs to come. If you are a long term investor,

forget about the correction that we are witnessing for past six months and stay

invested as a part of your wealth creation.

For tomorrow: Is the correction over? What are the key levels

to watch out for?

Happy Investing!

Comments

Post a Comment